Maximize Your Tax Refund with TurboTax : A Comprehensive Guide

Why TurboTax Is the Best Choice for Easy Tax Filing

TurboTax has emerged as a leading tax preparation software, revolutionizing the way both individuals and businesses approach tax filing. Founded in 1984, TurboTax has maintained a strong reputation in the market, evolving its offerings to meet the changing needs of its diverse user base. Its user-friendly interface and robust features make it an accessible choice for anyone seeking to maximize their tax refund.

One of the standout qualities of TurboTax is its ability to simplify the tax filing process. With a guided step-by-step approach, users can effortlessly navigate through the complexities of tax forms and regulations. The software actively prompts users for relevant information, ensuring that no critical details are overlooked. This smart technology not only streamlines the preparation process but also minimizes the likelihood of errors, which can lead to costly penalties or missed deductions.

TurboTax offers a variety of products tailored to fit the needs of different filers. Whether one is a self-employed individual, a small business owner, or an employee with straightforward income, there is a suitable option available. Additionally, TurboTax provides real-time updates on potential deductions and credits that might be applicable, empowering users to achieve the most favorable outcome in their tax filings.

Moreover, TurboTax stands out for its exceptional customer support services. Users have access to numerous resources, including a comprehensive knowledge base, community forums, and live assistance from tax professionals. This level of support further enhances the overall user experience, ensuring that help is readily available when needed.

Overall, Turbo Tax has carved a niche for itself in the competitive landscape of tax preparation software through its commitment to ease of use, comprehensive functionality, and dedication to customer satisfaction. As the tax season approaches, many individuals and businesses look toward TurboTax to simplify their filing experience and maximize their tax refunds.

Why Choose TurboTax for Your Tax Filing Needs?

When it comes to selecting a tax filing solution, Turbo Tax has established itself as a leader in the tax preparation software market. One of the primary reasons for its popularity is its user-friendly interface, which simplifies the complex process of filing taxes. By guiding users through each step with easy-to-understand prompts and well-structured layouts, TurboTax ensures that even those unfamiliar with tax filing can complete their returns with confidence.

In addition to its intuitive design, TurboTax offers a comprehensive customer support system. Whether users encounter technical issues or need assistance understanding specific tax-related questions, TurboTax provides multiple support channels, including live chat and phone support from experienced tax professionals. This level of accessibility sets TurboTax apart, making it a reliable choice for individuals who value prompt and effective assistance.

Another critical factor contributing to TurboTax’s appeal is its accuracy guarantee. Users can file their taxes with the knowledge that TurboTax employs advanced algorithms and regular updates to ensure calculations are correct, thus minimizing the risk of errors. This meticulous approach not only boosts user confidence but also reduces the chances of audits or penalties due to inaccuracies.

Moreover, Turbo Tax offers a variety of pricing options tailored to different user needs. Whether you are a simple filer with straightforward tax situations or a business owner with complex requirements, TurboTax has packages that cater to all. Users can choose from free versions to comprehensive premium plans, ensuring that there is a suitable option for everyone. This flexibility, combined with the quality of service, exemplifies why TurboTax remains a superior choice for tax filing.

Features of TurboTax Software

TurboTax software offers an array of robust features designed to simplify the tax filing process for users while maximizing their potential refunds. One of the most significant advantages is the step-by-step guidance provided throughout the entire tax preparation process. This feature ensures that users can easily navigate the complexities of tax codes and forms, even if they are not tax experts. The intuitive interface prompts users for relevant information, thereby streamlining data entry and reducing the likelihood of errors.

Another standout feature of Turbo Tax is its deduction and credit maximization tools. The software conducts a thorough analysis of users’ financial information to identify potential deductions and credits they may qualify for, ultimately increasing their tax refund. By utilizing an extensive library of tax-saving strategies, TurboTax can help both individuals and businesses leverage applicable tax breaks, which is particularly beneficial during tax season.

TurboTax also excels in its e-filing capabilities. Users can quickly file their taxes electronically, which speeds up the processing time for refunds significantly. E-filing not only offers convenience but also improves efficiency and accuracy as the software minimizes human error through automatic calculations. Furthermore, e-filing can help taxpayers receive their refunds faster, as it eliminates the delays often associated with mail-in submissions.

Security is another critical component of TurboTax software. With increased concerns about data privacy, Turbo Tax employs advanced security measures, including encryption and multi-factor authentication, to safeguard users’ personal and financial information. This commitment to security ensures that users can confidently prepare and file their taxes online without fear of identity theft or data breaches.

In conclusion, TurboTax software combines user-friendly features, deduction maximization capabilities, efficient e-filing options, and robust security measures, making it an ideal choice for individuals seeking to optimize their tax filing experience.

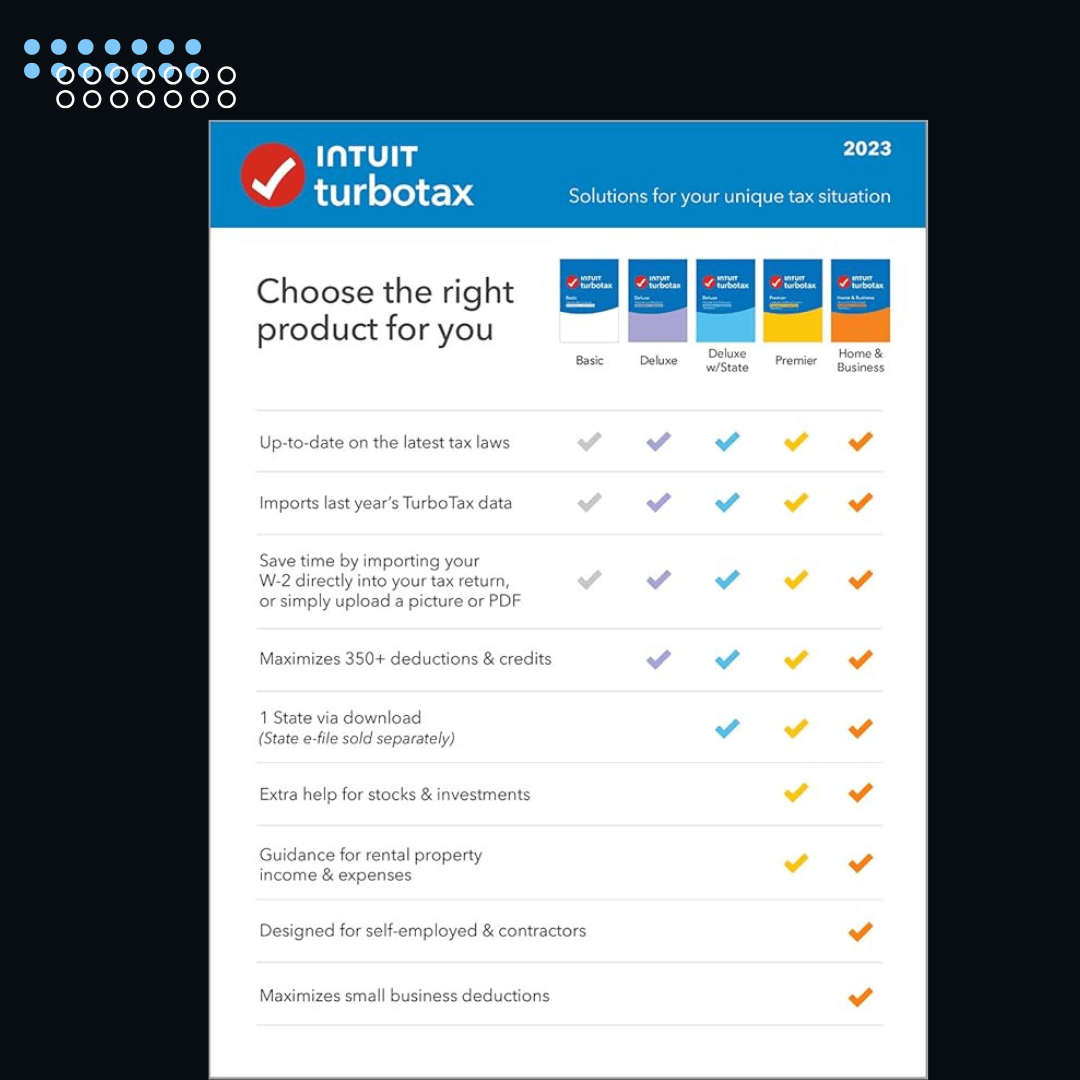

TurboTax Editions: Which One is Right for You?

When it comes to preparing your taxes, selecting the appropriate TurboTax edition is essential for maximizing your tax refund. Turbo Tax offers a range of editions tailored to meet diverse filing needs, including the Free Edition, Deluxe, Premier, and Self-Employed. Understanding the specific features and target audience for each edition can help you choose the most suitable option for your tax situation.

The TurboTax Free Edition is designed for individuals with simple tax situations, such as those filing a 1040 form and using standard deductions. It includes support for W-2 income, earned income tax credit, and child tax credit. This option is ideal for first-time filers or anyone whose financial circumstances do not involve complex tax scenarios.

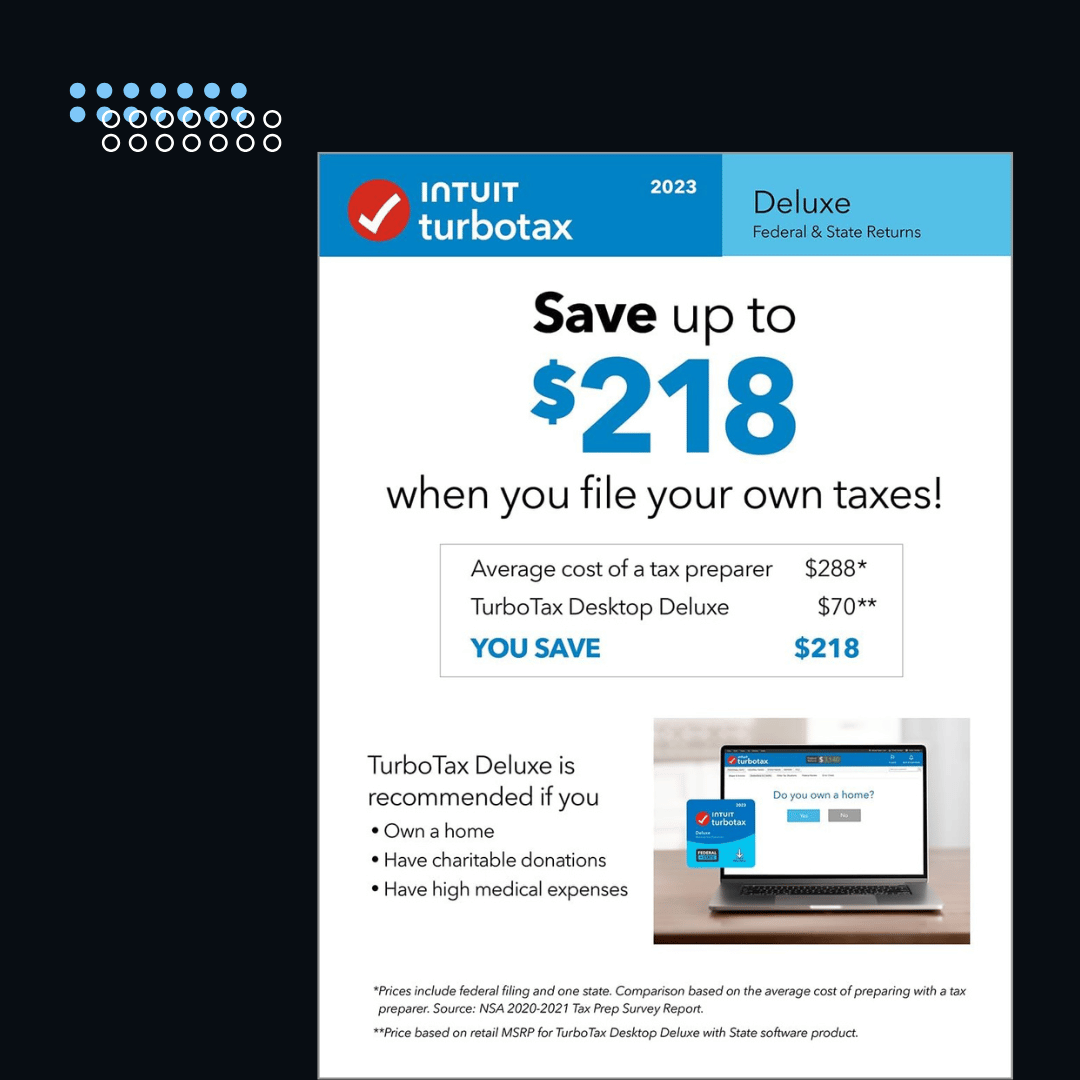

For users with more extensive tax needs, the Turbo Tax Deluxe edition offers additional features to maximize deductions. It is particularly beneficial for homeowners who require assistance with mortgage interest and property tax deductions. Deluxe also includes support for tax credits related to caregiving and medical expenses, making it an excellent choice for those seeking to maximize their tax refunds through itemized deductions.

Individuals with investments or rental properties may consider TurboTax Premier. This edition facilitates reporting for stocks, bonds, real estate, and other investment-related income. It also provides guidance on maximizing deductions for investment-related expenses and ensures compliance with applicable tax regulations.

Lastly, the Turbo Tax Self-Employed edition is specifically tailored for freelancers and business owners. It offers features to help track business income and expenses, and it maximizes eligible tax deductions, such as home office deductions and vehicle expenses. This edition ensures that self-employed individuals can navigate their unique tax situations effectively.

In summary, selecting the right Turbo Tax edition is crucial for optimizing your tax filing experience. By understanding the distinct features of each edition, you can choose the one that aligns with your individual tax circumstances, ultimately helping you maximize your tax refund.

Step-by-Step Guide on Using TurboTax

Using TurboTax is designed to facilitate a seamless tax filing experience. To begin, users must create an account. Visit the TurboTax website and select the appropriate version tailored to your tax situation, whether it’s for simple individuals, self-employed, or those with more complex financial scenarios. After selecting the version, you will need to enter your email address and create a password to establish your account.

Once the account is set up, you will be prompted to input personal information. This includes your name, address, Social Security number, and filing status. It is imperative to enter this information accurately, as mistakes can lead to delays or issues with your tax return. TurboTax provides step-by-step prompts to guide you through the necessary sections, and it is advisable to have all relevant financial documentation at hand, such as W-2 forms, 1099s, and any receipts for deductions.

After the initial setup, TurboTax utilizes its user-friendly interface to help you navigate through various sections, including income, deductions, and credits. Pay attention to the input fields; the software often includes helpful tips and explanations that can enhance your understanding of specific entries. To maximize your tax refund, make sure to explore all applicable deductions and credits by utilizing TurboTax’s tools, which can suggest opportunities based on your entered information.

As you complete each section, Turbo Tax will continuously perform checks to ensure compliance with tax regulations, alerting you to any potential errors or missed items. Once all information is entered, you will be guided through a review process, allowing you to confirm accuracy before filing. Finally, choose your filing method—e-filing is generally recommended for its efficiency and speed, ensuring you receive your tax refund as quickly as possible.

Common Tax Deductions and Credits with TurboTax

One of the significant advantages of using TurboTax is its ability to identify various tax deductions and credits that can substantially enhance your tax refund. Understanding these common deductions is essential for taxpayers looking to minimize their tax liability and maximize their refunds. TurboTax’s intuitive interface scans your financial information and suggests potential deductions tailored to your specific situation.

Among the most frequently claimed deductions is the standard deduction, which varies based on filing status. Taxpayers can choose between the standard deduction and itemizing their deductions, such as mortgage interest, property taxes, and charitable contributions. TurboTax helps users determine which method will yield better financial outcomes by calculating both options, providing clarity on the optimal choice.

Additionally, Turbo Tax identifies credits that can significantly reduce the amount of tax owed. For instance, the Earned Income Tax Credit (EITC) is available for those with low to moderate-income levels, while the Child Tax Credit offers substantial financial relief for families with dependent children. Using the software, users can easily assess their eligibility for these credits, ensuring that no potential benefit is overlooked.

Seasoned taxpayers should pay attention to deductions related to education expenses, such as the Lifetime Learning Credit and the American Opportunity Tax Credit. These credits directly support individuals pursuing higher education, and TurboTax seamlessly guides users through the documentation needed to claim them. Furthermore, self-employed individuals can take advantage of numerous business-related deductions, including home office expenses and health insurance premiums. TurboTax simplifies the process by prompting users to input their business expenses and offering suggestions to maximize eligible deductions.

In summary, by utilizing TurboTax, taxpayers can efficiently navigate common deductions and credits, ultimately increasing their tax refund potential. This comprehensive software not only streamlines the tax filing process but also empowers individuals to optimize their financial outcomes each tax season.

Troubleshooting and Support for TurboTax Users

Navigating tax preparation software can sometimes lead to challenges, and TurboTax users are not exempt from this experience. Fortunately, TurboTax provides a comprehensive array of support resources designed to assist users in efficiently resolving issues. Whether facing technical difficulties or needing guidance on tax-related questions, users can rest assured that help is readily available.

For those looking for immediate answers, the TurboTax website features a robust Frequently Asked Questions (FAQ) section. This resource encompasses a wide range of topics, addressing common concerns such as e-filing, deductions, and product navigation. Users can quickly locate relevant information by browsing categories or utilizing the search function, which streamlines the quest for solutions.

In addition to the FAQ, TurboTax offers several customer service options. Users can connect with support representatives through live chat, email, or by phone. The availability of these channels ensures that individuals can choose the method of communication that suits them best. It is important to note that peak tax season may result in longer wait times, so users are encouraged to reach out for assistance as early as possible.

Community forums also serve as a valuable resource, where users can interact with other TurboTax clients and tax professionals. These platforms provide insights and potential solutions that may not be covered in official documentation. Engaging in these forums can foster a sense of community and collaboration, allowing users to share experiences and advice.

Moreover, when dealing with common issues—such as software glitches or formatting errors—consulting the troubleshooting section of the TurboTax website can prove beneficial. This section outlines step-by-step guides to address prevalent problems, equipping users with the tools necessary to resolve issues independently. By leveraging these support resources, TurboTax users can confidently navigate through any challenges during the tax filing process.

Real User Testimonials and Case Studies

TurboTax has long been recognized as a reliable tax preparation software, and numerous users have shared their experiences highlighting its effectiveness in maximizing tax refunds and simplifying the filing process. These testimonials from both individuals and small businesses paint a vivid picture of how TurboTax has transformed their tax filing experience.

One user, Jennifer M., a freelance graphic designer, recounted her journey with TurboTax’s intuitive interface. “Before using TurboTax, I always felt overwhelmed by the complexity of tax forms. The guided process made it so easy for me to navigate through my deductions and credits. I ended up receiving a refund that was larger than I ever expected,” she shared. Her story illustrates how the software not only streamlines preparation but also enhances users’ understanding of their financial situations.

Moving into the realm of small businesses, Gary T., who owns a local café, emphasized the importance of the software’s capabilities in handling business-specific deductions. “TurboTax helped me identify expenses I wouldn’t have considered. The result was a significant reduction in taxable income, allowing me to reinvest that money back into my café,” he articulated. This testimonial showcases how TurboTax is not only suitable for individual taxpayers but also a valuable resource for small business owners aiming to maximize their tax refunds.

Additionally, a case study involving a family of five highlighted TurboTax’s effectiveness in managing multiple income streams, including investments and rental properties. The family reported that the comprehensive reporting features and ease of integration significantly contributed to an impressive tax refund that they utilized towards their children’s education. Such real-world examples underline the substantial benefits TurboTax offers users in diverse financial situations.

These testimonials and case studies demonstrate a consistent theme: TurboTax equips users with the tools and insights necessary to maximize their tax refunds efficiently. The experiential accounts of Jennifer, Gary, and many others substantiate the software’s reputation as an essential asset for effective tax management.

Is TurboTax the Right Choice for You?

TurboTax has established itself as a leading option in the realm of tax preparation, appealing to a wide demographic of users from individuals with straightforward tax situations to those with more complex financial scenarios. As discussed, TurboTax’s intelligently designed interface, step-by-step guidance, and robust features cater to different tax needs, making it an appealing choice for many potential users. Its user-friendly platform simplifies the filing process, transforming what can often be a daunting task into a manageable and even approachable endeavor.

When evaluating whether TurboTax is the right choice for you, consider your unique tax circumstances. For taxpayers with simple returns, the free version may suffice, allowing you to file at no cost while still benefiting from TurboTax’s intuitive features. On the other hand, individual circumstances such as home ownership, investment income, or self-employment entail more complicated tax scenarios that may require the advanced tools offered in one of TurboTax’s paid versions. The premium versions provide access to additional support, including personalized guidance from tax experts and deductions tailored to various situations.

It is essential to assess not only your current tax situation but also your comfort level with technology and financial matters. Those who appreciate a hands-on approach and wish to be heavily involved in the preparation process may find TurboTax particularly suitable. Conversely, if you prefer a full-service model where a professional takes over the entire tax preparation task, you might consider other alternatives. Ultimately, TurboTax delivers a versatile solution that can simplify the taxing process, but its appropriateness relies on thoughtful consideration of individual preferences and financial circumstances. Engaging with the software through its free trial may also provide insight into whether it aligns with your expectations and needs.

Share this content:

Post Comment