Quack AI Governance: Ensuring Responsible AI Use

Can a blockchain protocol truly let a community make faster, fairer decisions without losing control?

Discover how smart models and on-chain systems work together. This article gives a clear, beginner-friendly tour of quack ai governance and the protocol’s core capabilities.

The platform combines automation with audit trails across Ethereum, Solana, TON, and other networks. Over 660,000 users and 40+ projects already participate. That scale shows real market interest and ecosystem maturity.

Expect practical clarity. We explain AI agents, real-time proposal execution, cross-network reach, and how certificates turn chat activity into measurable influence. Funding of $3.6M led by Animoca Brands, Kenetic Capital, and Skyland Ventures adds credibility.

Finally, you’ll see how transparency and safeguards keep the system reliable. We focus on utility, long-term value signals, and sensible price expectations so you can engage with confidence—bien sûr, with clear next steps!

Key Takeaways

- Learn how a protocol ties intelligence to on-chain audits for faster DAO decisions.

- See why 660,000+ users and 40+ projects signal ecosystem trust.

- Understand certificates, agent delegation, and real rewards from chat participation.

- Recognize cross-chain reach keeps the platform flexible and market-ready.

- Funding and safeguards point to durable innovation and responsible operation.

What Is Quack AI Governance On-Chain and Why It Matters Today

Imagine decision cycles that once took weeks happening in hours across multiple blockchains. This is the practical promise behind quack governance and modern on-chain governance.

Simple definition for newcomers

On-chain governance means rules, voting, and outcomes are executed and recorded on a blockchain. Every action is auditable and permanent. That builds community trust and clear accountability.

Why it matters now in the U.S. and global ecosystems

Regulators in the United States demand transparency while Web3 ecosystems push for verifiable process. A protocol that merges automated analysis with on-chain records answers both needs.

- Faster decisions: algorithms convert discussion into actions without manual delays.

- Better clarity: data and analysis improve proposal readability before voting.

- Cross-chain reach: blockchain governance across Ethereum, Solana, TON avoids siloed outcomes.

For you, the result is streamlined participation and reliable insights that preserve accountability. The protocol aligns incentives across the community and scales with compatibility in evolving ecosystems.

How quack ai governance Works: From AI Agents to Real-Time Execution

A clear path links user signals to executed protocol changes in near real time.

Start by connecting your wallet. Use Chat to Earn to collect points (20 per question, up to 100 daily). Convert points into certificates that represent governance power. This is the earn→convert step—simple and transparent.

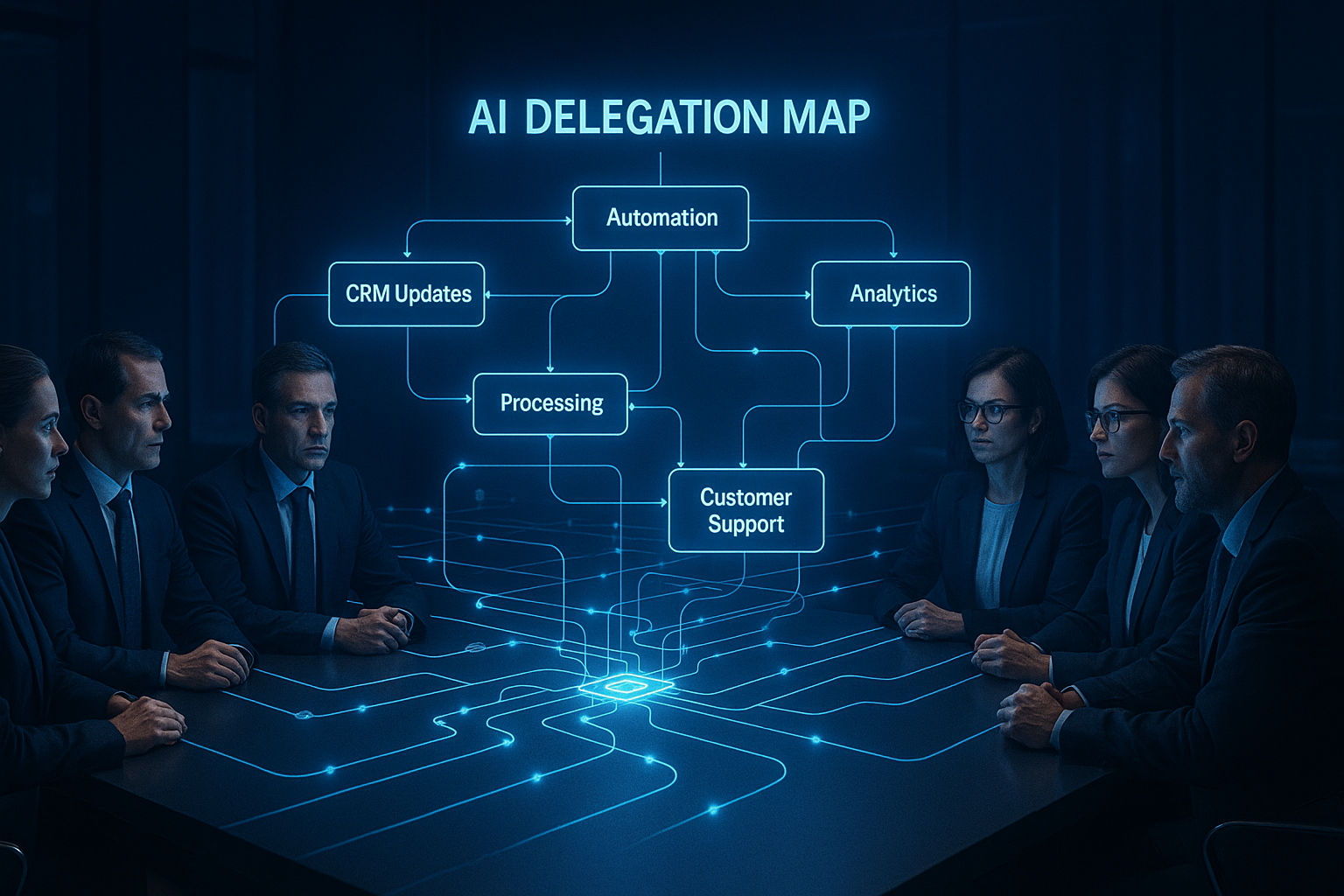

Agents then help you decide. Delegated agents use predictive algorithms, NLP sentiment, and historical voting patterns to produce recommendation and proposal analysis. They flag anomalies and surface risk before a vote.

From votes to execution

When a proposal moves to voting, certificate holders or their agents cast votes. Smart contracts enforce outcomes automatically, so execution is fast and auditable.

| Step | Action | Result |

|---|---|---|

| Earn | Chat to Earn (20 pts/question) | Points accumulate (max 100/day) |

| Convert | Points → Certificates | Governance power tokenized |

| Delegate | Assign to agent | Automated recommendation & voting |

| Execute | On-chain voting | Smart contract enforces outcome |

Cross-chain compatibility supports EVM, Solana, and TON so actions and fees are optimized. The system keeps analysis repeatable and auditable, giving you confidence to participate without extra friction.

Key Features and Benefits: Automating DAO Decisions Across Ecosystems

This layer turns member activity into practical tools for faster, verifiable community decisions. It converts engagement into transferable certificates that back representative voting and real-time action.

AI representative voting and governance certificates

Governance certificates let you delegate voting power to trusted agents while keeping accountability on-chain. You retain control—delegation is reversible and auditable.

Real-time proposal evaluation and implementation

Proposals move from submission to execution in minutes, not weeks. Automated evaluation uses rules and thresholds so communities act when market conditions demand it.

Comprehensive data integration: on-chain, off-chain, sentiment, and market

The system ingests on-chain transactions, forum feedback, market sentiment, and historical votes for consistent analysis. That blend of data improves recommendations and reduces noise.

Improved participation, faster proposals, and reduced manual overhead

- Efficient voting: certificates convert participation into influence for delegated voting.

- Clear analysis: documented rationale and auditable scoring simplify decisions.

- Better management: automation frees moderators for higher-value work and expands participation across time zones.

The platform’s capabilities deliver practical solutions: cleaner processes, stronger strategies, and measurable innovation—all backed by cross-chain blockchain execution you can verify.

DeFi Integration and On-Chain Governance: Risk, Treasury, and Protocol Controls

Communities can adjust lending rates and liquidity incentives through clear, auditable votes that execute immediately on-chain. This gives you direct control of protocol health while keeping every change transparent.

Dynamic parameter management covers lending rates, liquidity rewards, collateral ratios, and token distribution. Proposals set these levers and smart contracts apply the outcome without manual delay.

AI-driven risk assessment, monitoring, and anomaly detection

Continuous monitoring scans price feeds, on-chain flows, and liquidity pools for early signs of stress. Machine learning flags anomalies and suggests mitigations before shocks escalate.

Transparent treasury management and cross-protocol coordination

Treasury operations are fully auditable on blockchain ledgers. Every inflow and outflow is visible, supporting strong stewardship and trust.

- Dynamic control: vote to change interest, rewards, or collateral immediately.

- Risk monitoring: automated risk assessment and alerts reduce manual burden.

- Auditable treasury: transparent treasury management improves accountability.

- Cross-protocol strategies: coordinate liquidity and risk posture across protocols for greater resilience.

The platform’s solutions create a feedback loop: proposal results produce data, teams refine strategies, and policy evolves. This integration aligns traders, LPs, and developers on shared objectives and safer operations.

Getting Involved: Tokens, Participation Paths, and Market Context

You can convert everyday engagement into certificates that carry real voting weight. Before $AIQ lists, the fastest path is participation. Chat to Earn awards 20 points per question, up to 100 daily. Convert points into certificates to gain early governance influence.

$AIQ utility, staking, and influence

$AIQ powers delegation, proposal analysis, and automated voting. Staking can boost your influence and align long-term incentives with the platform’s goals. These actions add measurable weight to voting and management decisions.

Before listing: earning points and converting to governance power

Start now by earning points through Chat to Earn and converting them into certificates. This gives you usable utility before public markets open. Focus on learning and participation—price visibility is pending until listing.

Using Bitget Wallet: discovery, trading pairs, and monitoring once listed

Once listed, Bitget Wallet will support discovery and trading pairs. Always verify the official contract address at listing to avoid spoofed assets. Monitor market activity and price carefully before acting.

“Community participation now builds the influence that markets will later price.”

- Action: Earn → Convert → Stake for greater voting power.

- Safety: Verify contract addresses and follow official channels.

- Perspective: Track roadmap and development updates; releases can shift market sentiment.

Integration with major networks ensures your influence travels as the protocol expands. Regular participation compounds community influence and provides clearer insights into platform direction.

Partnerships, Adoption, and Ecosystem Momentum

Strategic partners and active projects have turned early development into visible momentum.

Backers matter: a $3.6M raise led by Animoca Brands, Kenetic Capital, and Skyland Ventures signals institutional confidence. That funding supports disciplined development and practical expansion.

Network alliances and integration

Alliances with BNB Chain, Linea, Metis, Taiko, TONScale Labs, CARV, zkLink, and DuckChain widen tooling and protocol interoperability. These ties make integration faster for new protocols and lower onboarding friction.

Adoption and community impact

More than 660,000 users and 40+ projects use passports and governance integrations today. Active participation shows the ecosystem delivers real solutions, not just promise.

- Resilience: broader network reach reduces single‑chain risk.

- Utility: DAOs and DeFi projects gain standardized, AI‑assisted operations that cut manual work.

- Market signal: each integration improves perception and paves the way for fair price discovery post‑listing.

For the community, that means better tooling, credible partners, and a clearer path from pilot to production.

Security, Transparency, and Governance Safeguards

Audit trails and execution controls work together to keep risk low and trust high. This approach centers on public records, careful review windows, and continuous checks so you can verify actions quickly.

On-chain auditability means proposals, voting, and transactions are recorded and viewable on the ledger. That delivers clear blockchain governance where anyone can confirm how decisions were reached.

Smart contract audits and timed execution

Third-party audits verify contract logic before deployment. Time-locks give the community a predictable window to review major updates. These steps reduce operational risk and boost execution integrity.

Post-deployment monitoring and assessment

Continuous monitoring tracks live behavior and flags anomalies. Post-implementation checks validate that outcomes match approved governance proposals and that treasury moves follow declared policy.

Product clarification and mission separation

Quack AI is a blockchain protocol focused on on-chain governance and protocol controls. It is separate from Quack.ai, which builds customer support tools. The teams, products, and missions differ.

- Every vote and policy change is immutable and auditable on blockchain.

- Transparent assessment criteria make proposal outcomes reproducible and fair.

- Protocols that follow these safeguards standardize change management and ease compliance.

| Safeguard | Purpose | Benefit |

|---|---|---|

| On-chain records | Store proposals, votes, transactions | Public verification and long-term accountability |

| Third-party audits | Review smart contract code | Reduced execution risk and higher confidence |

| Time-locks | Delay execution for review | Opportunity to catch issues before change |

| Continuous monitoring | Track live system behavior | Fast detection and remediation of anomalies |

Roadmap and Future Development: From Public Beta to Full Autonomy

Roadmap phases emphasize user access first, then smarter models and broader chain expansion. This keeps delivery practical and measurable.

The 2025 roadmap starts with a public beta in Q2. Token holders get agent access and guided tutorials. In Q3 the platform activates self-learning models and expands to Ethereum and TON. Q4 brings decentralized panels with AI facilitation and outreach to institutional Web2 partners.

Phased vision and integrations

Practical phases focus on AI scoring for clearer proposal analysis and cross-chain strategies that deepen compatibility. Multi-chain asset management centralizes treasury control in the platform UI.

- Delivery-first: public beta → learning model → chain expansion.

- Consistency: AI-driven scoring adds clear, data-based analysis for voting and proposal prioritization.

- Resilience: cross-chain integration reduces fragmentation and supports defi operations.

Long term: panels evolve into self-executing, verifiable systems with risk signals feeding decision loops. Users gain guided flows and better management tools as the ecosystem matures.

Conclusion

Ultimately, the system offers a practical bridge between member activity and secure, auditable action in live markets.

This platform turns earned points into certificates you can use today. Convert engagement, delegate to trusted agents, and watch voting and execution happen with time‑locks and third‑party audits for safety.

Decentralized governance here means fast, verifiable results. On‑chain governance records keep proposals and voting transparent and repeatable across Ethereum, Solana, TON and partner networks like BNB Chain and Linea.

With 660,000+ users, 40+ projects, and $3.6M in backing, the platform delivers practical solutions for DAOs and defi teams. Focus on participation and learning; price discovery and market dynamics will follow fundamentals.

Next step: join, earn points, convert certificates, and help shape reliable governance proposals in a verifiable platform.

FAQ

What is Quack AI Governance: Ensuring Responsible AI Use?

What does “on-chain” mean in the context of Quack AI Governance and why does it matter now?

How do AI agents and predictive algorithms work inside the system?

What are governance certificates and “Chat to Earn” delegation mechanics?

How does on-chain voting turn into automated smart contract execution?

Can this system operate cross-chain across Ethereum, Solana, TON, and others?

What are the core features that improve DAO decision-making?

How does the platform integrate with DeFi for risk and treasury controls?

What token mechanics and participation paths are available?

Which partners and ecosystem players support this model?

How many users and projects participate currently?

What safeguards ensure transparency and security?

How is Quack AI different from other similarly named products?

What does the roadmap look like for public beta and full autonomy?

How are risk, monitoring, and anomaly detection handled in production?

How can my community get involved or integrate these tools?

Share this content:

Post Comment