AI Driven Finance Strategy: From Buried in Dashboards to Strategic Insight

The Critical Shift: From Reactive Reporting to Real-Time Insights

Traditional finance functions have long been trapped in a cycle of backward-looking activities. Teams spend up to 80% of their time collecting, validating, and reconciling data, leaving precious little capacity for the analysis and insights that drive business value. This reactive approach creates a perpetual game of catch-up where finance professionals are historians rather than strategic advisors.

The Reactive Finance Trap

In the reactive model, finance teams are characterized by:

- Manual data collection across disparate systems

- Spreadsheet-driven analysis with high error potential

- Month-end close processes that consume weeks

- Historical reporting that arrives too late for decision-making

- Limited capacity for forward-looking analysis

This approach leaves finance teams perpetually explaining “what happened” rather than influencing “what should happen next.” The business impact is significant: missed opportunities, delayed course corrections, and strategic decisions made without complete financial context.

The AI-Enabled Finance Future

An AI driven finance strategy transforms this paradigm by:

- Automating data collection and validation processes

- Enabling continuous close capabilities

- Providing real-time visibility into financial performance

- Identifying patterns and anomalies proactively

- Generating predictive insights for decision support

This transformation shifts finance from a reactive function to a proactive strategic partner. With AI handling routine tasks, finance professionals can focus on interpretation, scenario planning, and strategic guidance that drives business value.

Technology Enablers for the Transformation

The shift to an AI driven finance strategy is powered by several key technologies:

Machine Learning

Algorithms that identify patterns in financial data, learn from historical transactions, and improve accuracy over time. ML enables anomaly detection, forecast accuracy, and process automation.

Natural Language Processing

Technology that interprets and generates human language, enabling automated reporting, document analysis, and conversational interfaces for financial data access.

Predictive Analytics

Statistical techniques that analyze current and historical data to make predictions about future outcomes, enabling more accurate forecasting and scenario planning.

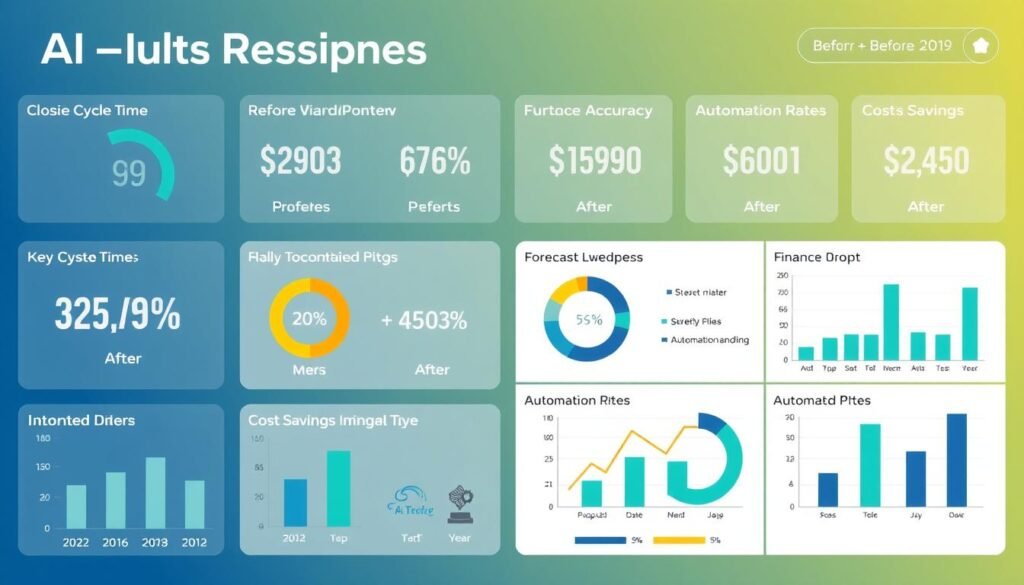

3 Key Benefits of Implementing an AI Driven Finance Strategy

Organizations that successfully implement AI-driven finance capabilities realize substantial benefits that extend far beyond cost savings. These benefits create a practical roadmap for finance transformation that delivers measurable value.

1. Operational Efficiency and Cost Reduction

AI-powered automation dramatically reduces the manual effort required for routine finance tasks:

- Transaction Processing: AI can automate up to 80% of accounts payable and receivable processes, reducing processing costs by 40-60%.

- Financial Close: Organizations using AI-driven close processes report 70% faster close cycles and 50% reduction in manual journal entries.

- Audit and Compliance: AI tools can review 100% of transactions rather than samples, reducing audit costs while improving compliance.

2. Enhanced Decision Support and Risk Management

AI transforms finance’s ability to provide strategic guidance and manage risk:

- Predictive Forecasting: AI models can improve forecast accuracy by 25-50%, enabling more confident business planning.

- Risk Detection: Machine learning algorithms identify potential fraud or compliance issues before they impact the business.

- Cash Flow Optimization: AI-driven treasury functions can improve working capital by 15-25% through optimized cash positioning.

3. Strategic Business Partnership

With routine tasks automated, finance teams can elevate their role:

- Business Insights: Finance professionals can spend 60% more time on analysis and strategic support.

- Scenario Planning: AI enables rapid modeling of multiple business scenarios with detailed financial implications.

- Value Creation: Finance teams can identify new revenue opportunities and cost optimizations worth 3-5% of revenue.

Ready to Transform Your Finance Function?

Discover how leading organizations are implementing AI-driven finance strategies to shift from reactive reporting to strategic insight. Our comprehensive guide provides a practical roadmap for your transformation journey.

Real-World Impact: AI Driven Finance Strategy in Action

Organizations across industries are realizing significant benefits from implementing AI-driven finance capabilities. These case studies demonstrate the practical application and measurable results of this transformation.

Global Manufacturing Firm

Implemented AI driven forecasting and automated transaction processing:

- Reduced month-end close from 12 days to 3 days

- Improved forecast accuracy by 35%

- Automated 78% of accounts payable processes

- Reallocated 12 FTEs from processing to analysis roles

Financial Services Provider

Deployed AI for risk detection and cash flow optimization:

- Identified $4.2M in potential fraud through pattern recognition

- Reduced working capital requirements by 18%

- Automated 92% of regulatory reporting processes

- Decreased compliance costs by 30%

Healthcare Organization

Implemented AI for revenue cycle management and cost analysis:

- Reduced claim processing time by 65%

- Improved cash collection by $12M annually

- Identified $8.5M in cost reduction opportunities

- Decreased reporting cycle time by 75%

“Implementing an AI driven finance strategy wasn’t just about technology—it was about fundamentally reimagining how our finance team creates value. We’ve shifted from spending 80% of our time on transaction processing to dedicating 70% of our capacity to strategic business partnership.”

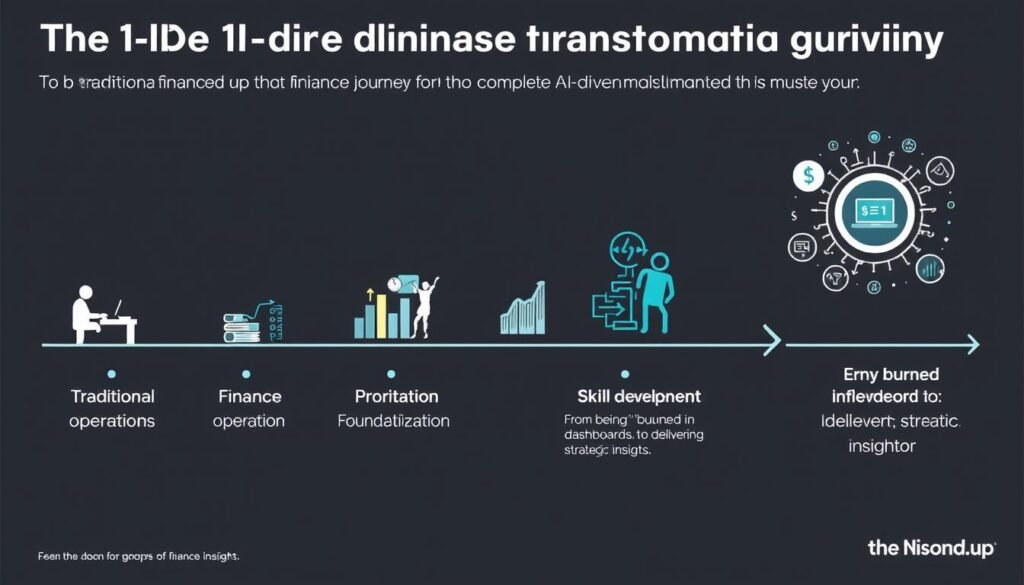

Your 5-Step Implementation Plan for AI Driven Finance

Transforming your finance function with AI requires a structured approach that balances quick wins with long-term strategic change. This practical roadmap provides a framework for successful implementation.

-

Assess Your Current State and Define the Vision

Begin by evaluating your finance function’s current capabilities, pain points, and strategic priorities:

- Map existing processes and identify high-effort, low-value activities

- Quantify the cost and impact of manual processes and data limitations

- Define a clear vision for how AI will transform finance’s role in your organization

- Establish measurable objectives and key results (OKRs) for the transformation

-

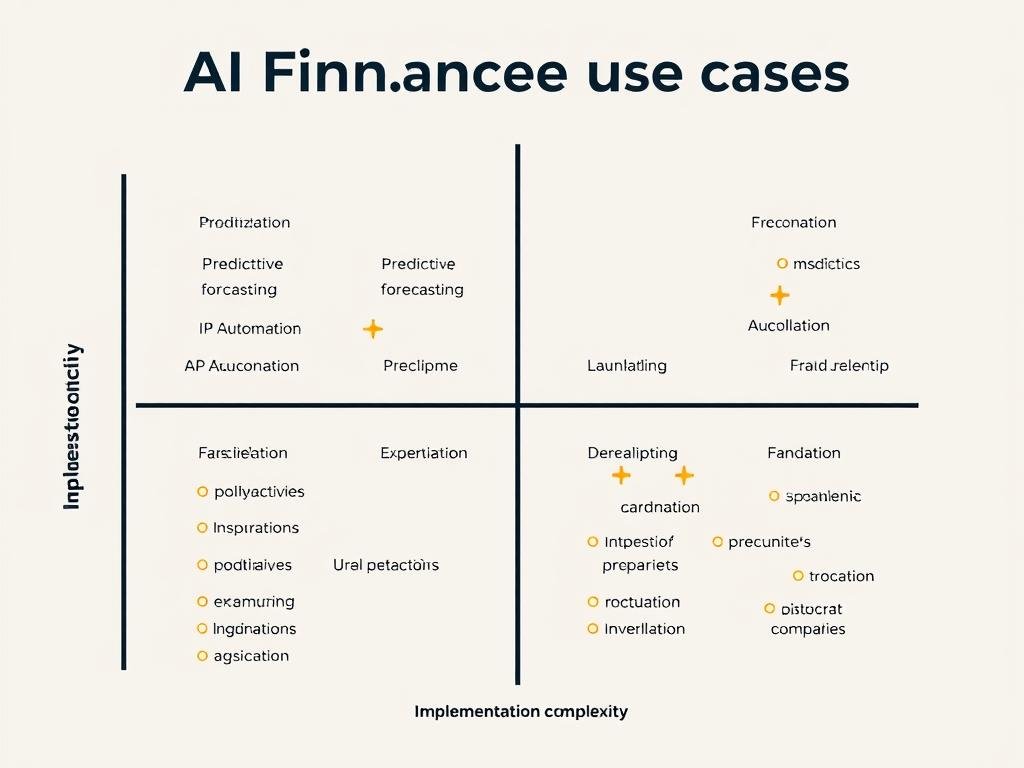

Prioritize Use Cases for Maximum Impact

Not all AI applications deliver equal value. Focus on use cases that offer the best combination of feasibility and impact:

- Transaction processing automation (accounts payable/receivable)

- Automated reconciliations and journal entries

- Predictive cash flow forecasting

- Anomaly detection for fraud and error prevention

- Intelligent reporting and data visualization

-

Build the Foundation: Data and Technology

AI effectiveness depends on data quality and technology infrastructure:

- Assess data quality, availability, and integration requirements

- Implement data governance and standardization processes

- Evaluate AI platform options (build vs. buy decisions)

- Establish cloud infrastructure for scalability and performance

-

Develop Skills and Change Management

The human element is critical to successful AI implementation:

- Identify skills gaps and develop training programs

- Create new roles that combine finance expertise with data literacy

- Implement change management to address resistance and build buy-in

- Establish governance frameworks for AI deployment and oversight

-

Implement, Measure, and Scale

Take an iterative approach to implementation:

- Start with pilot projects to demonstrate value and build momentum

- Establish clear metrics to measure impact and ROI

- Create feedback loops to continuously improve AI models

- Scale successful use cases across the organization

- Continuously identify new opportunities for AI application

Need a Detailed Implementation Blueprint?

Our comprehensive guide provides step-by-step instructions, templates, and best practices for implementing an AI-driven finance strategy in your organization.

Navigating Common Challenges in AI Finance Transformation

While the benefits of an AI driven finance strategy are compelling, implementation comes with challenges that must be addressed proactively.

Implementation Strategies

- Data Quality Issues: Implement data governance frameworks and cleansing processes before AI deployment.

- Technology Integration: Use API-based approaches to connect AI solutions with legacy systems.

- Skills Gaps: Develop hybrid teams combining finance expertise with data science capabilities.

- Change Resistance: Focus on how AI augments rather than replaces finance professionals.

- ROI Concerns: Start with high-impact use cases that demonstrate quick wins and clear value.

Common Pitfalls

- Technology-First Approach: Focusing on AI tools before defining clear business objectives.

- Ignoring Process Redesign: Automating broken processes rather than reimagining workflows.

- Underestimating Change Management: Failing to address cultural and organizational impacts.

- Neglecting Governance: Implementing AI without appropriate controls and oversight.

- Big Bang Implementation: Attempting large-scale transformation without proving value through pilots.

“The biggest mistake we made was treating our AI implementation as a technology project rather than a business transformation. Success came when we focused on how AI would change our operating model and the capabilities our team needed to deliver value in new ways.”

The Future of AI Driven Finance: Emerging Trends

As AI technology continues to evolve, new capabilities are emerging that will further transform finance functions. Forward-thinking organizations are already exploring these advanced applications.

Autonomous Finance

AI systems that can execute routine financial processes with minimal human intervention:

- Self-adjusting forecasting models

- Automated financial close processes

- Dynamic cash management

- Continuous audit and compliance monitoring

Cognitive Insights

Advanced AI that generates strategic recommendations based on financial and operational data:

- Opportunity identification

- Predictive risk assessment

- Scenario planning and simulation

- Strategic investment optimization

Finance Digital Twins

Virtual models of finance operations that enable simulation and optimization:

- Process optimization testing

- Organizational design simulation

- Financial impact modeling

- Predictive performance management

Conclusion: The Imperative for AI-Driven Finance Transformation

Finance teams stand at a critical inflection point. The traditional model of reactive reporting and manual processes is no longer sustainable in a business environment that demands foresight, agility, and strategic partnership. An AI driven finance strategy offers a practical roadmap to transform from being buried in dashboards to delivering strategic insights that drive business value.

The benefits are clear: operational efficiency that reduces costs, enhanced decision support that improves outcomes, and strategic partnership that creates competitive advantage. Organizations that successfully implement AI in finance don’t just improve the function—they fundamentally change how finance contributes to business success.

The time to act is now. As the gap widens between traditional finance capabilities and business expectations, organizations that delay transformation risk falling behind competitors who are already leveraging AI to create more agile, insightful finance functions. The business demands foresight, and AI-driven finance is the key to delivering it.

Transform Your Finance Function Today

Get your comprehensive guide to implementing an AI driven finance strategy. Learn how to shift from reactive reporting to strategic insight with our practical roadmap for finance transformation.

Share this content:

Post Comment